Obtain Your Reimbursement Faster with a Secure Australian Online Tax Return Declaring Choice

Obtain Your Reimbursement Faster with a Secure Australian Online Tax Return Declaring Choice

Blog Article

Why You Must Think About an Online Income Tax Return Process for Your Monetary Demands

In today's busy atmosphere, the on-line income tax return procedure provides an engaging remedy for managing your monetary responsibilities efficiently. By leveraging electronic systems, people can enjoy the benefit of filing from home, which not just conserves time but likewise decreases the anxiety related to traditional methods. These platforms offer enhanced precision and protection attributes, along with the possibility for price savings. The real advantage might lie in the access to specialized sources and support that can significantly influence your tax end result. The concern remains: how can these benefits change your economic method?

Ease of Online Filing

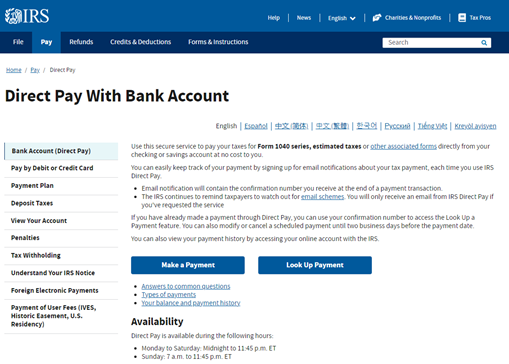

The comfort of online filing has actually reinvented the way taxpayers approach their income tax return. In an age where time is useful, online tax declaring platforms offer taxpayers with the flexibility to finish their returns from the comfort of their workplaces or homes. This ease of access gets rid of the requirement for physical trips to tax obligation preparers or the blog post workplace, dramatically minimizing the inconvenience typically related to traditional declaring methods.

Additionally, on-line filing solutions offer easy to use user interfaces and step-by-step assistance, allowing people to navigate the procedure with simplicity. Lots of systems integrate attributes such as automated estimations, error-checking, and instant accessibility to prior year returns, boosting the overall declaring experience. This technological improvement not just simplifies the prep work procedure yet additionally empowers taxpayers to take control of their monetary responsibilities.

Additionally, on the internet filing enables the seamless integration of various tax papers, including W-2s and 1099s, which can frequently be imported straight right into the system. This streamlining of details minimizes data entrance errors and boosts accuracy, making sure a more trustworthy submission (Australian Online Tax Return). Ultimately, the ease of online declaring represents a substantial change in tax prep work, lining up with the developing requirements of modern taxpayers

Time Efficiency and Speed

Prompt completion of tax returns is an important aspect for lots of taxpayers, and on the internet filing significantly boosts this aspect of the process. The digital landscape improves the whole income tax return process, minimizing the moment needed to collect, input, and send needed details. On-line tax software usually consists of features such as pre-filled forms, automatic estimations, and easy-to-navigate interfaces, allowing customers to complete their returns extra efficiently.

Moreover, the capability to gain access to tax documents and info from anywhere with an internet connection removes the need for physical documents and in-person visits. This adaptability makes it possible for taxpayers to deal with their returns at their comfort, thus decreasing the anxiety and time stress commonly related to typical filing techniques.

Cost-Effectiveness of Digital Solutions

While several taxpayers may initially perceive on the internet tax filing options as an added expenditure, a closer examination reveals their inherent cost-effectiveness. Digital platforms usually come with lower fees contrasted to traditional tax obligation preparation solutions. Numerous online suppliers use tiered pricing frameworks that allow taxpayers to pay only for the solutions they really need, decreasing unneeded costs.

Additionally, the automation inherent in on-line services streamlines the declaring procedure, lowering the likelihood of human mistake and the possibility for costly revisions or fines. This effectiveness converts to substantial time savings, which can correspond to economic savings when taking into consideration the hourly rates of professional tax obligation preparers.

Enhanced Precision and Safety And Security

Along with enhanced precision, online tax declaring additionally prioritizes the safety of delicate individual and economic information. Reliable online tax obligation services use robust encryption modern technologies to protect information transmission and storage space, dramatically minimizing the threat of identification theft and fraud. Regular protection updates and conformity with industry requirements better strengthen these defenses, supplying comfort for users.

Furthermore, the capability to accessibility tax obligation papers and information securely from anywhere enables greater control over individual financial information. Customers can conveniently track their declaring condition and fetch vital papers without the danger related to physical duplicates. Generally, the mix of enhanced accuracy and safety makes on-line tax submitting a sensible option for people seeking to simplify their tax obligation preparation process.

Access to Professional Assistance

Accessing expert assistance is a considerable benefit of online tax obligation filing platforms, official website supplying users with support from experienced specialists throughout the tax obligation prep work process. A number of these systems offer accessibility to qualified tax professionals who can help with complicated tax issues, making certain that individuals make informed choices while maximizing credit scores and reductions.

This professional support is frequently readily available through numerous channels, including live conversation, video clip phone calls, and phone consultations. Such ease of access enables taxpayers to seek clarification on details tax obligation legislations and laws or receive individualized suggestions tailored to their unique financial circumstances (Australian Online Tax Return). Furthermore, having an expert handy can reduce the stress and anxiety connected with tax declaring, especially for individuals dealing with complicated financial circumstances or those not familiar with the most recent tax obligation codes.

Furthermore, on-line tax obligation systems often supply a wealth of resources, such as instructional video clips, write-ups, and Frequently asked questions, boosting users' understanding of their tax obligation obligations. This detailed assistance system not only promotes self-confidence during the filing procedure but likewise outfits users with important understanding for future tax years. Eventually, leveraging expert support via on the internet income tax return processes can bring about more exact filings and optimized economic end results.

Conclusion

To conclude, the on the internet income tax return process provides significant benefits for people looking for to manage their monetary needs efficiently. The ease of filing from home, combined with time performance, cost-effectiveness, boosted precision, and durable security, underscores its allure. Moreover, access to experienced support and resources encourages customers to enhance deductions and streamline their tax obligation experience. Accepting electronic services for tax prep work inevitably represents a forward-thinking approach to economic administration in a find more information significantly electronic world.

Prompt completion of tax obligation returns is a vital element for many taxpayers, and on-line filing significantly boosts this facet of the process. By guiding customers via the filing process with user-friendly prompts and mistake alerts, on-line remedies assist to get rid of usual mistakes, leading to a more exact tax return.

Overall, the combination of heightened precision and security makes on the internet tax filing a smart choice for people seeking to streamline their tax obligation prep work process.

Having a specialist on hand can relieve the anxiety connected with tax filing, particularly for people encountering complex financial scenarios or those unknown with the most recent tax codes.

Furthermore, on-line tax obligation platforms regularly give a wide range of sources, such as instructional videos, articles, and FAQs, enhancing users' understanding of their tax responsibilities.

Report this page